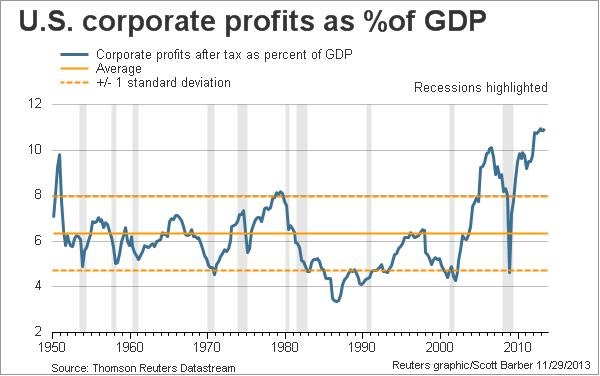

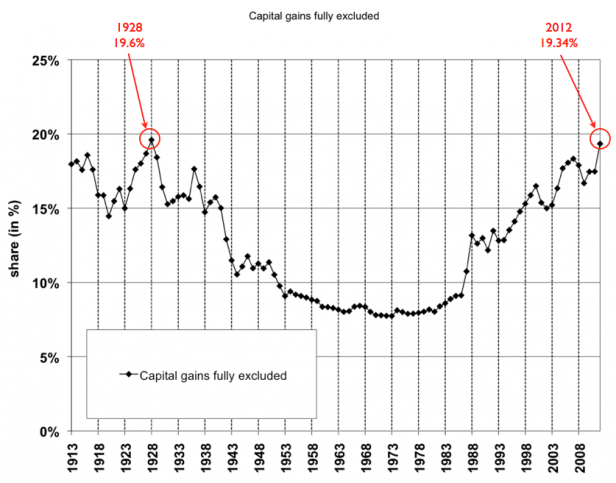

“Finally we have Summers’ role in the 2008-2009 financial crisis. Summers was one of the people who pushed the Democrats in Congress to accept the no (real) conditions TARP bailout given to them by Henry Paulson. Once in the White House he was the staunch defender of the bankrupt banks belligerently challenging anyone who proposed letting the market work its magic and put these behemoths out of our misery. As a result of Summers’ work the too big to fail banks are bigger and more profitable than ever.”

“Finally we have Summers’ role in the 2008-2009 financial crisis. Summers was one of the people who pushed the Democrats in Congress to accept the no (real) conditions TARP bailout given to them by Henry Paulson. Once in the White House he was the staunch defender of the bankrupt banks belligerently challenging anyone who proposed letting the market work its magic and put these behemoths out of our misery. As a result of Summers’ work the too big to fail banks are bigger and more profitable than ever.”

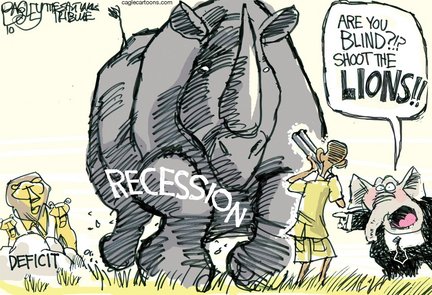

As Summers supporters — including the President — try to push him for Federal Reserve Chairman (over the more experienced Janet Yellen), Dean Baker asks the obvious question: At this late date, why, exactly, should Larry Summers be head of anything? “In short, if we look at Larry Summers track record in dealing with crises it is pretty abysmal. But on attendance, he gets an ‘A.'”

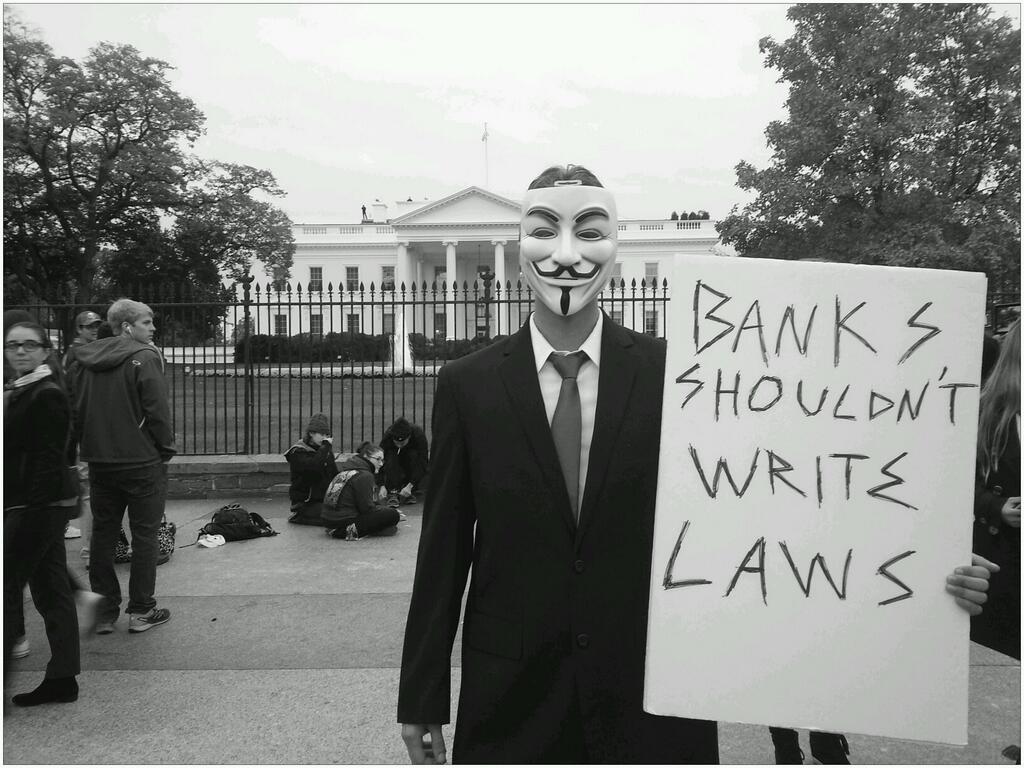

Seriously, how many more times does this guy have to be wrong? And why pick for Fed Chair someone, as Sheila Bair succinctly put it, who was clearly “part of the deregulatory cabal that got us into the 2008 financial crisis?”

And, let’s be clear: Even putting that trillion-dollar fiasco aside — other than that, Mrs. Lincoln, how was the play — from attacking Brooksley Born in the late 90’s to his embarrassing interim at Harvard (where, on top of everything else, Wonderboy lost the endowment $2 billion) to ham-stringing the 2009 stimulus out of the gate, everything Summers touches turns to lead.

But, lo, here he is once again, being force-fed to us by the usual suspects as a brilliant speaker of economic truths. Yet another classic case of failing-up in Washington, where it’s always better to be wrong and with the herd than prescient and correct.

Update: “Although Summers had been an early advocate of Warren’s idea to establish a consumer regulator to deal with abusive lending, he was rankled by the support she received from other administration officials, particularly Christina Romer, who chaired Obama’s Council of Economic Advisers.” Among his many other sins, Summers also went out of his way to block Elizabeth Warren as CFPB head — a bureau she in effect created — apparently because of personal pique. So, yeah, let’s put this guy in charge. He is so SMRT!