“Barack Obama proposes a painful hit to middle-class and working-class seniors, in return for an increase on taxes on the rich so small that they will hardly notice. Bargain? Yes. Grand? Not so much. By legitimating changes that could lead over time to the conversion of Social Security into a means-tested program for the elderly poor only, Barack Obama has proven himself to be a true and worthy successor of his predecessor, George W. Bush.”

“Barack Obama proposes a painful hit to middle-class and working-class seniors, in return for an increase on taxes on the rich so small that they will hardly notice. Bargain? Yes. Grand? Not so much. By legitimating changes that could lead over time to the conversion of Social Security into a means-tested program for the elderly poor only, Barack Obama has proven himself to be a true and worthy successor of his predecessor, George W. Bush.”

As Obama — to no one’s surprise who was watching the last two years closely — definitively reveals he wants to go all Nixon-in-China on Social Security, Michael Lind notes the many similarities between Bush and Obama on social insurance. “Both Bush and Obama crafted their Social Security plans solely with an eye to the approval of the bipartisan economic elite, most of whom prefer cutting Social Security benefits, which they don’t need, to raising taxes on members of their class.”

One key difference: When Dubya tried to slash Social Security benefits in 2005, Democrats stood up as one against him. Now that an ostensible Dem is in the White House and wants to enact social insurance benefit cuts for ridiculous reasons, not so much. But this time, we can’t countenance the usual Third Way spinelessness. As PCCC’s Stephanie Taylor said: “‘You can’t call yourself a Democrat and support Social Security benefit cuts…The President has no mandate to cut these benefits, and progressives will do everything possible to stop him.'”

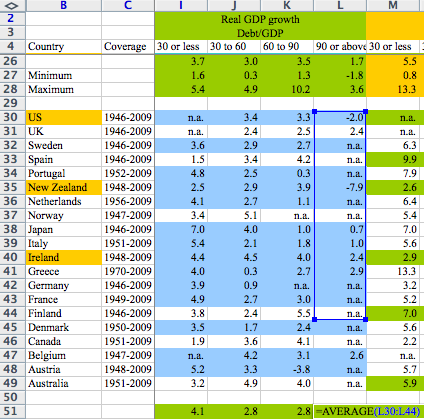

***“People really don’t like deficits…But hold on a second. Why do we hate deficits? ‘Balancing the budget’ sounds really nice, but what reason do we have to believe it’s actually valuable?” In the WP and in very related news, Dylan Matthews

punctures the various talking points driving deficit hysteria:

“We’re broke! America is going to be bankrupt! We’re really not. The U.S. Treasury never has to default on any of its debts. That’s because we control our own currency. If we owe debts and don’t have the tax revenue to pay them, we can always just print the money and hand it over. That may not be the best approach, and in the very worst-case scenario this leads to hyperinflation so bad that defaulting is the less-bad option. But we’re so far from that situation today that worrying about it doesn’t seem worthwhile.”

***Update:

“The president’s major purpose is not to address mass unemployment, not to build a new foundation for the economy, not to revive the middle class or redress Gilded Age inequality. The president’s overriding priority is to cut a deal – and a deal that continues to impose austerity on an already faltering recovery.”

As Obama’s budget is officially released — $2 of spending cuts for every dollar in revenue is NOT a good thing. See also: Austerity in Europe — Robert Borosage reads the administration the riot act. See also Bob Kuttner: “You can understand Republicans wanting to crush government and hoping to slow the recovery in a way that harms the Democrat in the 2014 midterm elections. But what is the president thinking?…Now voters can conclude that they can’t trust either party.”

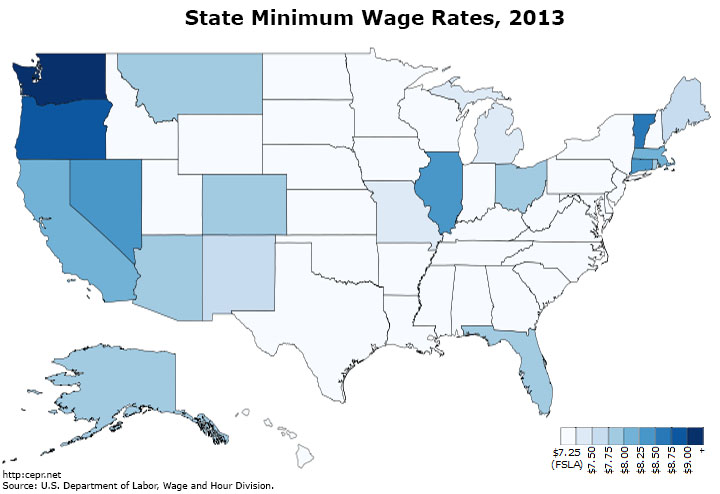

Oh yeah, and all that happy talk about addressing climate change and raising the minimum wage in the State of the Union? You won’t see it in this budget. Meanwhile, the GOP are loading up the cannons.