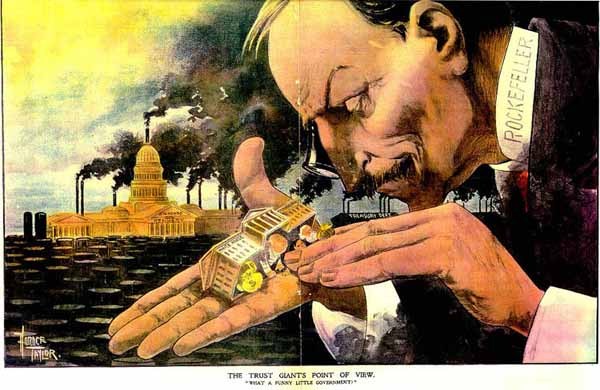

In the NYRB, and in very related news, Paul Krugman sings the praises of Thomas Piketty’s new magnum opus, Capital in the 21st Century. “This is a book that will change both the way we think about society and the way we do economics…Piketty has transformed our economic discourse; we’ll never talk about wealth and inequality the same way we used to.”

As a counterpoint of sorts, CEPR’s Dean Baker — neither a Pollyanna nor a conservative — argues Piketty has picked up some of Marx’s bad habits, and finds the book too deterministic and despairing by far:

“[T]here are serious grounds for challenging Piketty’s vision of the future…the book [suffers from a] lack of attentiveness to institutional detail…In the past, progressive change advanced by getting some segment of capitalists to side with progressives against retrograde sectors. In the current context this likely means getting large segments of the business community to beat up on financial capital…[T]he point is that capitalism is far more dynamic and flexible than the way Piketty presents it in this book. Given that we will likely be stuck with it long into the future, that is good news.”

Update: Galbraith weighs in. “[This] is a weighty book, replete with good information on the flows of income, transfers of wealth, and the distribution of financial resources in some of the world’s wealthiest countries…Yet he does not provide a very sound guide to policy. And despite its great ambitions, his book is not the accomplished work of high theory that its title, length, and reception (so far) suggest.”