“The Fed accepted a total of $1.31 trillion in junk-rated collateral between Sept. 15, 2008 and May 12, 2009 through the Primary Dealer Credit Facility. TARP was nothing compared to this.” (Also, $500 billion of that junk was rated CCC or below, which — given the rampant grade inflation going on at all the rating agencies — means it was really garbage.)

So, yeah, Wikileaks isn’t the only document dump in town this week. As mandated by the Dodd-Frank Act (after much pushing from below), the Federal Reserve today released information about some of its dealings from December 2007 to July 2010. And, while folks are just now delving into the intel, it already seems that some of the bodies buried during the financial crisis are now floating to the surface: “A quick analysis…indicates that Citigroup was the greatest beneficiary, drawing on a total of $1.8 trillion in loans, followed by Merrill Lynch, which used $1.5 trillion; Morgan Stanley, which drew $1.4 trillion; and Bear Stearns, which used $960 billion.“

In very related news, former Alan Grayson staffer (and a Hill friend of mine) Matthew Stoller lays out a compelling case for a harder stance against the Fed from the Left from now on. Some brief excerpts:

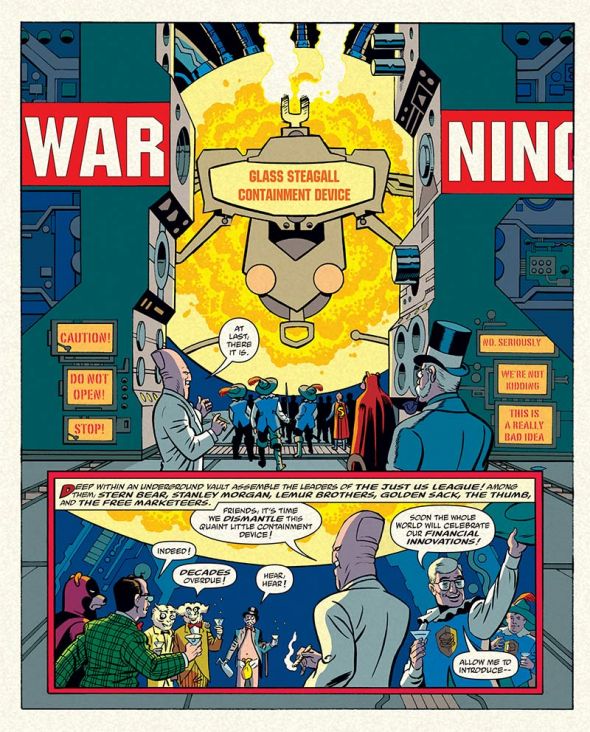

“It is good that this debate is happening. It means that we will be able to examine the real power structure of the American order, rather than the minor food fights allowable in our current political system. This will bring deep disagreements, profound ones, but also remarkable possibility. Modern American industrial policy is to push capital into housing, move manufacturing abroad, build a massive defense establishment, and maintain an oligarchic financial sector. This system isn’t a structural inevitability. People built it, and people are unbuilding it…

Like most American institutions, the Fed has shrouded itself in myth, with self-serving officials discussing the immaculate design of the central bank as untouchable, secretive, an autocratic and technocratic adult in the world of democratic children. But the Fed, and specifically the people who run it, are responsible for declining wages, for de-industrialization, for bubbles, and for the systemic corruption of American capital markets.”

Also on this topic, it comes out today that Bank of America was given a break by the SEC on a securities fraud settlement “‘because of the nation’s perilous economic situation at the time’ and the fact that it had received billions of dollars in taxpayer aid, according to the report by the SEC’s inspector general…Specifically, during settlement negotiations, Bank of America won relief from sanctions that could have hurt its investment banking business.“

To tie this back to the top, according to Bloomberg’s Lizzie O’Leary, who’s also been parsing the new Fed data, “52% of the collateral Bank of America pledged to the #Fed’s PDCF was rated Ba/BB or lower, or didn’t have available ratings.” (And, let’s keep in mind, PDCF was only one of several emergency programs.)

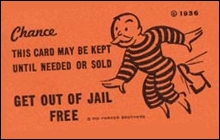

So, in other words, the government kept banks like BoA alive by buying up trillions in toxic assets and looking askance at their illegal activity. They repaid us with record bonuses for themselves and an epidemic of foreclosure fraud — the “getaway car for the financial crisis,” as a friend well put it — that’s screwing over millions of American families. And in terms of fixing bad behavior on the Street, nothing changed whatsoever. Boy, that’s some deal.