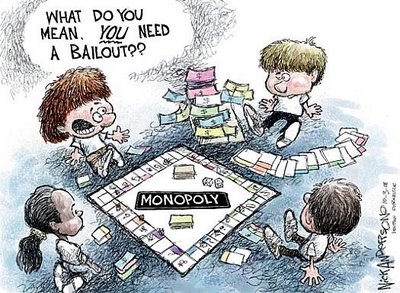

Common Cause president Bob Edgar reads Obama the riot act for his many transgressions on the campaign finance front. “He still has time to change course and I’m enough of an optimist to hold out hope that he will. But it’s getting tougher.” On this as on so many other fronts, I myself am no longer that optimistic. (Obama Lucy picture via this Atlantic Monthly article.)

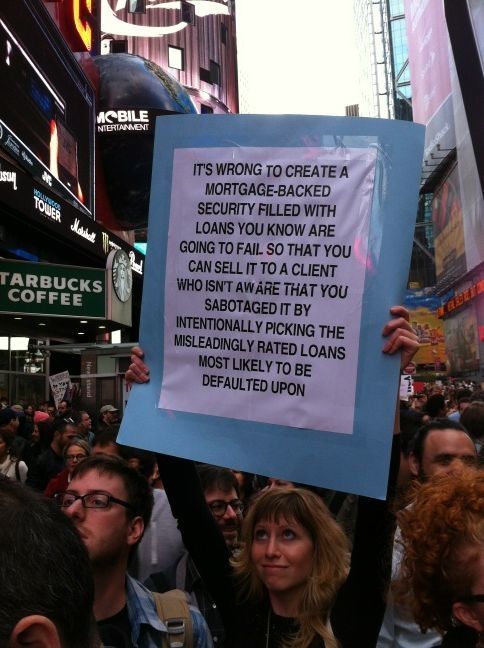

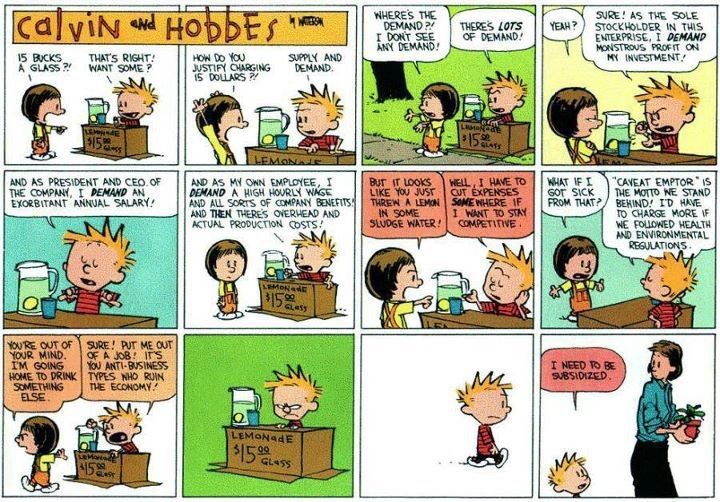

“We talk a lot about broken models. The DC progressive model is broken. It does nothing but facilitate the injustices readily evident in this case.” In related news, and in the wake of his recent Salon piece about the administration’s phantom financial fraud task force, Dave Dayen argues its time for progressive organizations in DC to get adversarial or go home. “Well-meaning people all over this country concerned about any number of issues hand over their hard-earned money to these groups, and they aim to speak broadly for liberal values. The accountability doesn’t stop on Wall Street. It needs to be shared by the DC progressive community.”

Update: “There’s a certain conventional wisdom that President Obama wants stronger campaign finance laws, and to protect our democracy from the corrupting effects of money in politics. It’s a story that you should no longer believe.” The Sunlight Foundation weighs in against Obama as well. “The arc of the Obama presidency may be long, but so far, it has bent away from transparency for influence and campaign finance, and toward big funders.”