Not unlike most of the policies articulated by this administration, Dubya’s protectionist steel tariff has backfired in every way possible. “The strategizing was ‘too clever by half,’ [Bruce] Bartlett, the [conservative] economist, said. ‘It presupposed that nobody was watching what we were doing, and it presupposed that our credibility was of no importance.’” Sound familiar? But, hey, give credit where credit is due…under the Bushies, the rich are getting richer.

Tag: Inequality

When the Sun Never Sets.

“The Rove-Bush goal is to return government to its size before the New Deal, leaving the individual more exposed to corporate power than at any other time since the 1920s.” Jack Beatty of The Atlantic Monthly examines Rove’s long-term strategy for the Dubya tax cut, and how it’s cleverly designed to help the GOP in 2004 and 2008. Grim stuff. In a related story, Michael Kinsley offers his take on the dividend debacle: “The recently enacted tax bill is such a shocking and brazen gift for the wealthy that it is hard to describe in anything short of…cartoon-Marxist terms.”

Credit Denied.

Despite growing GOP support in the Senate, Tom De Lay refuses to consider an increased low-income child tax credit in the House unless it includes more schwag for the filthy rich, such as an estate tax repeal. Speaking of which, new analyses of the Dubya debacle suggest that the middle class will end up footing the bill while the wealthy frolic. So much for “trickle-down.”

Cash Advance.

As it turns out, Dubya’s profligate ways have forced Congress to increase the federal debt limit (so as to avoid a government default) in the very week they mull over his (now Voinovich-friendly) tax giveaway for the rich. Coincidence? I think not.

Capital Gains, National Losses.

The House and Senate GOP agree on a compromise bill that cuts the tax rates on dividends to 15%. (Don’t worry, Mr. Burns – the wealthy also get their fix in the form of a capital gains rate cut to 15%.) But, problems for the dividend debacle remain…particularly in that the $383 billion package goes over the $350 billion cap established by GOP moderate George Voinovich. Can the Dems mount a last stand?

A Sucker Born Every Minute.

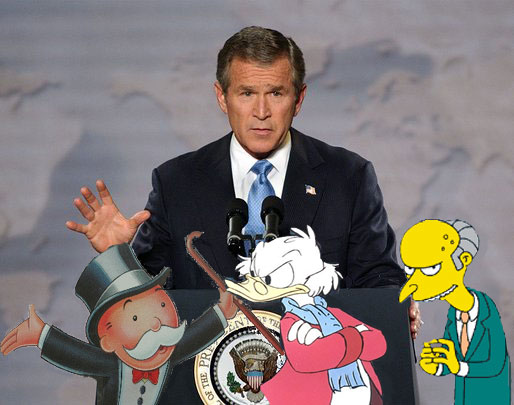

The President and his cabinet take the Dubya dividend debacle dog-and-pony show on the road. But be careful if they come to your town – as per usual when Dubya and the economy are mentioned in the same sentence, you may just find yourself working overtime. Update: Proving once again the power of the Big Lie, Dubya accuses tax cut critics of “class warfare.” And in a joint statement, Montgomery Burns, Scrooge McDuck, and the Monopoly Guy asked, “Can’t we all just get along?”

The Other Shoe Drops.

As it turns out, the new GOP-spawned hybrid tax bill mentioned yesterday offers even more to the wealthy (and less to the poor) than Dubya’s dividend debacle. Why am I not surprised? If the Republicans keep prostrating themselves before the filthy rich like this, that giant sucking sound you hear will be the GOP moderates defecting en masse a la James Jeffords, who’s now comfortably ensconced in the Democratic leadership.

Taxing Times.

Despite the administration’s attempt to use the war to promote tax cuts, the Senate does the right thing and slashes Dubya’s tax giveaway in half. As I said last week, it’s almost obscene to even consider this type of deficit-busting sop for the rich when America’s fighting men and women are laying their lives on the line. In times of war, even (gasp!) the affluent must bear their share of sacrifice.

Ailing Body Politic.

As the GOP Senate flexes its newfound muscle and slashes a number of domestic programs, President Clinton emerges to assail Dubya’s health policies. Keep it up, Republicans, and watch Dubya’s numbers founder.

True Colors Shining Through.

As we embark on war in the Middle East and the states grapple with their worst fiscal crises in a generation, Dubya moves once again to protect the wealthy by eliminating taxes on dividends, despite the minimal effect it’ll have on economic growth. Typical. I’ve wondered aloud (10/12) about the double taxation on business profits before, but that was in better times, before Dubya blew out the economy with his deficit-exploding tax plan of 2001. (Speaking of which, thanks for the 300 bucks. It changed my life.) Given our dire economic situation and wartime footing now, it’s almost criminal to eliminate dividend taxes to aid stockholders, particularly when high payroll taxes continue to consume the balance of working Americans’ paychecks. (Of course, Dubya plans to pay for all this by freezing all domestic spending except homeland security.) Absolutely ridiculous…How out of it can you be? What will this plan do for the millions of Americans who don’t play the stock market? Are they suppose to pay for the war in Iraq while the wealthiest Americans watch their bank accounts grow? I swear the Monopoly guy must be taking meetings with Karl Rove somewhere in the West Wing.