As it turns out, I was able to make it to the John Edwards event on campus this morning, and, all in all, I’d give him a B+. He both read and rushed through the first half of his remarks, which involved some new formulation of his trade policy (more on that in a second), and I found his opening lines particularly ham-handed and speechwriterly. “I know y’all have been waiting for a Son of the South to come to NYC…A-Rod,” he said (and I’m paraphrasing.) “Well, I’m not A-Rod, but Wisconsin proved one thing: I can close!” Um, ok, but A-Rod is a shortstop and all, not a closer.

Anyway, nitpicking aside, Edwards improved measurably once he put the paper down and got into the rhythm of his “Two Americas” stump speech, which he’d clearly delivered many times. There were moments, however, when he definitely could have embellished his standard schtick, given the crowd. Edwards talked about how he was a lonely, legal David often going up and winning cases against a Goliath-sized team of corporate lawyers, a biographical stat which probably plays great in the Heartland. It went flat here, though, perhaps because the many law students in the auditorium seemed confused by his remarks: But we want to be those well-paid corporate shills!

Still, Edwards came off extremely polished and personable, and he definitely got the crowd on his side, even when he was blindsided by a sneak “Campaign on AIDS!” protest on the dais behind him. Several members of the VIP crowd unveiled red-ribbon shirts and began chanting right in the middle of his biographical portion (In fact, I could’ve sworn it was right after he gave the “son of a millworker” line, which was a clever signal to choose, if nothing else.) Edwards gave them a moment, asked the crowd to applaud the “activism of these young people,” calmly told a heckler he’d address their point after finishing his bio, and then said a few positive words about fighting AIDS at home and abroad (A critical world issue to be sure, but not a particularly controversial one in this day and age…c’mon, y’all, this isn’t 1988. And why try to derail a candidate who is politically sympathetic to your cause, particularly when Karl Rove is across town?) At any rate, no harm no foul for Team Edwards: He navigated this potentially rocky shoal extremely successfully, although I presume some advance guy or gal was given the serious what-for soon thereafter.

As for the trade stuff, I liked where he was going at first, but he eventually seem to fall back on the fair trade side of the usual dichotomy. As I see it, the problem isn’t free trade itself per se as much as the loss of American jobs, as well as the ugly spectacle of corporations firing tons of US workers only to turn right around and offer up a fat dividend. Edwards obliquely mentioned this formulation, then fell back on tax breaks for “good” corporations and the trouble with NAFTA. My feeling is, if you want to stop this kind of behavior, there needs to be more stick and less carrot. Hit business where it hurts: Tax the heck out of (or even, God forbid, disallow) corporate dividends that occur in the same fiscal year as the downsizing of X number of American jobs. Simply put, if you can’t afford to pay your workers anymore, you damn well shouldn’t be paying dividends to stockholders. Edwards came close to saying thus, but then fell back into the old free trade/fair trade rut, which to my mind is a bit like shouting into the wind. If you want to change corporate behavior, focus on corporate behavior…don’t blame the increasingly irreversible trend of globalization.

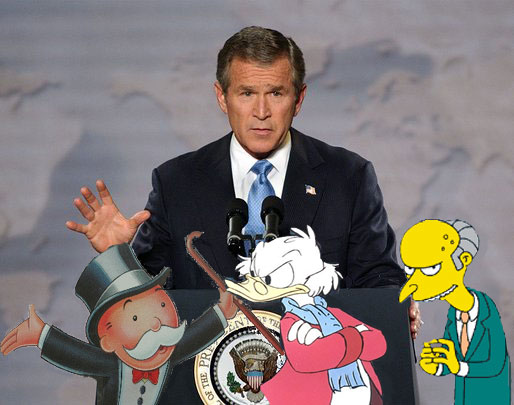

At any rate, all in all Edwards came off quite well, although not as inspiring or Clintonesque as I would’ve originally liked. He’s definitely got a great future in the party and in American politics, and he’d no doubt make a solid contender in this election season against the likes of Dubya (or Dick Cheney.)