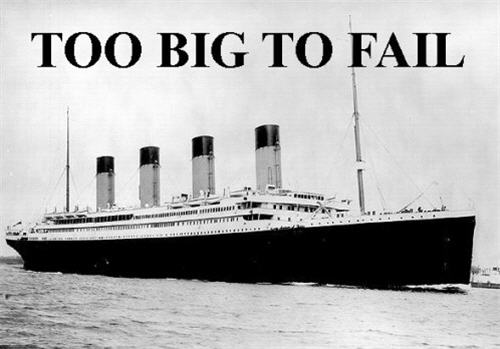

“The contrast in fortunes between those on top of the economic heap and those buried in the rubble couldn’t be starker. The 10 biggest banks now control more than three-quarters of the country’s banking assets. Profits have bounced back, while compensation at publicly traded Wall Street firms hit a record $135 billion in 2010. Meanwhile, more than 24 million Americans are out of work or can’t find full-time work, and nearly $9 trillion in household wealth has vanished. There seems to be no correlation between who drove the crisis and who is paying the price.“

As Bank of America pays a pittance to other banks for its malfeasance, former chair of the Financial Crisis Inquiry Commission Phil Angelides looks into how the winners are now rewriting the history of the 2008 financial collapse. “So, how do you revise the historical narrative when the evidence of what led to economic catastrophe is so overwhelming and the events at issue so recent? You and your political allies just do it. And you bet on the old axiom that a lie is halfway around the world before the truth can tie its shoes.” Attorney General Schneiderman, our nation turns its lowly eyes to you.