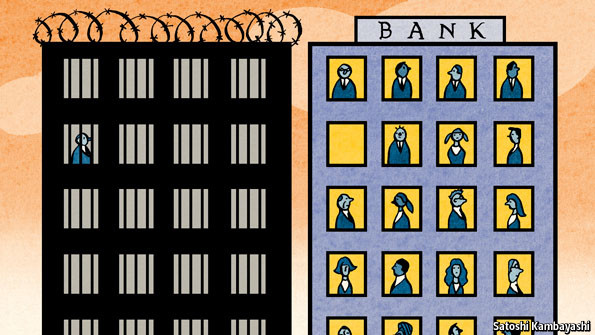

A tale of two financial crimes: After

the Savings and Loan Crisis of the late 80’s and early 90’s — a

clear consequence of Reagan-era deregulation, by the way — had run its course,

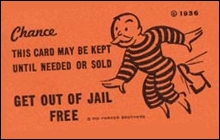

1852 S&L officials were prosecuted, and 1072 of them ended up behind bars, as did over 2500 bankers for S&L-related crimes. But, when a similarly-deregulated Wall Street plunged the US economy into a much steeper recession two decades later…nobody (with the

notable exception of Bernie Madoff) went to jail — In fact, it was

barely even admitted by the powers-that-be that

serious crimes had even occurred at all. So what happened?

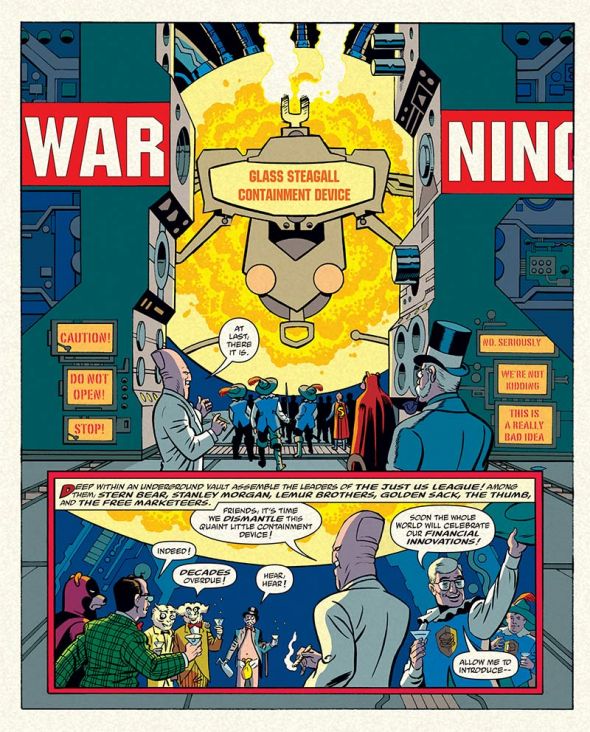

That is the stark question driving Charles Ferguson’s well-laid-out prosecutorial brief Inside Job, which works to explain exactly how we ended up in the most calamitous economic straits since the 1930s. If you’ve been keeping up on current events at all, even if by comic books, stick figures, or Oliver Stone flicks, then you won’t be surprised by the frustrating tale Inside Job has to tell. But unlke the more inchoate and disorganized Casino Jack and the United States of Money earlier this year, which ultimately let its subject wriggle off the hook, Inside Job tells its sad, sordid story clearly, concisely, and well.

The central through-line of the financial crisis by now is well-known. Basically, Wall Steet banksters — relying heavily on “market innovations” (i.e. unregulated toys) like securitization, collaterized debt obligations (CDOs) and credit default swaps — spent the first decade of the 21st century engaged in a trillion-dollar orgy of avarice, criminality, and fraud. And, a few prominent casualties like Lehman Brothers and Bear Stearns aside, the perpetrators of these financial misdeeds mostly walked away unscathed from the economic devastation they wrought. In fact, they’re doing better than ever.

Said banksters got away with this from start to finish mainly becauset they could, thanks to thirty years of deregulation and an absolute bipartisan chokehold on the political process. So, when the bill came due in 2008, these masters of the free market just got the Fed to socialize their losses, thus handing the damage over to the American taxpayer by way of Secretary of the Treasury Hank Paulson (former Chairman and CEO of Goldman Sachs) and his successor, Tim Geithner (no stranger to Wall Street himself.)

As I said recently, my thoughts on the relative necessity of TARP have shifted a good deal since 2008, but, surprisingly, Ferguson doesn’t really get into that debate here. Inside Job is more broad in its focus: It aims instead to show how Wall Street has systematically corrupted both our political process and our economics departments over the course of decades, and nobody is safe from its wrath. Sure, it was probably a tremendously bad idea to let an Ayn Rand acolyte like Alan Greenspan call the shots for the American economy for so long, but he’s just the tip of the iceberg. There are other fish to fry.

After all, it is President Clinton and his financial lieutenants, Robert Rubin and Larry Summers, who preside over the death of Glass-Steagall, the original sin that precipitates all the later shenanigans. It is also they who work to keep prescient regulators like Brooksley Born from sounding the alarm. And, after the house of cards has collapsed in 2008, and President Obama steps up to the plate promising “change we can believe in,” who does he pull out of the bullpen to lead us but…the irrepressibly porcine Larry Summers and Tim Geithner, the Chair of the New York Fed? Meet the new boss, same as the old boss. (But remember, folks, Obama is really an anti-business socialist.)

What goes for the US government goes for the academy as well. As Ferguson shows, Milton Friedman aficionadoes and Reagan/Bush policy guys like Marty Feldstein of Harvard and Glenn Hubbard of Columbia, who now find themselves atop prestigious Ivy League economics departments, are all too happy to give an academic imprimatur to bad bankster behavior, as long as they see a piece of the cut. (Nobody gets it worse than Columbia prof and former Fed governor Frederic Mishkin, who appears here to have walked into a battle of wits completely unarmed.)

In the meantime, Ferguson fleshes out the documentary with related vignettes on the financial crisis and those who brought us low — some work, some don’t. The movie begins with the cautionary tale of Iceland, about as pure a real-time case study into the abysmal failures of deregulation as you can ask for. (If that doesn’t do ya, try Ireland.) But the film ends as badly as it starts well, with an overheated monologue about the way forward, cut to swelling music and images of the Statue of Liberty — a cliche that serves to dissipate much of the pent-up anger of the last 90 minutes. (Perhaps Inside Job should’ve used the lightning strike.)

What’s more, at times Ferguson seems to try too hard to frame guilty men, and never more so than when he has a former psychiatrist-to-the-bankster-stars opine about cocaine abuse and prostitution all over the Street. Sure, it’s unsavory, and I see the ultimate point here — that these petty crimes could’ve been used to flip the lower-level traders if anyone had had tried to bring a RICO case against these jokers. But this sort of bad behavior, however frat-tastically douchey, is extraneous to the real crime at hand, and it seems really out of place when you’re using fallen crusader Elliot Spitzer as a witness for the prosecution.)

Still, overall, Inside Job is a very solid documentary that manages to capture its elusive quarry, and in a better world it would result in more serious consequences for the banksters who put us in this mess. Make no mistake — this is a crime story. As Massachusetts rep Michael Capuano observes in the trailer, and as Woody Guthrie put it many moons ago, “some rob you with a six-gun, and some with a fountain pen.” Thing is, when Pretty Boy Floyd or John Dillinger robbed banks back in the day, they got shot. When the banks rob you…well, that’s apparently another thing entirely.