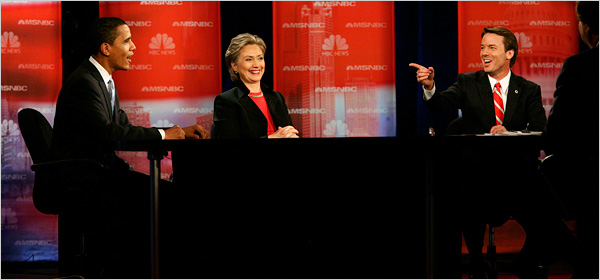

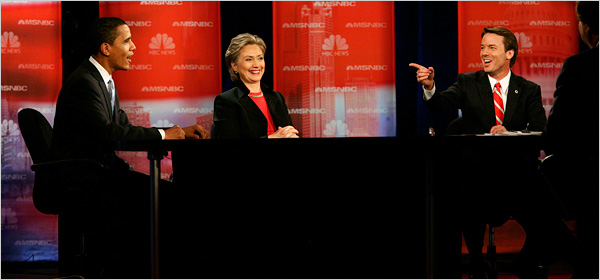

Despite the best efforts of Tim Russert, who asked rinky-dink meta-questions about the past week for most of the first segment, the Democratic debate in Los Vegas was a pause for breath tonight, with Barack Obama, John Edwards, and Hillary Clinton all going out of their way to dial back the heat and try to bridge the identity politics chasms that have yawned open of late. As such, with all three candidates on their best behavior and looking to avoid direct confrontations that might get nasty, it was the type of debate that made the party and all three contenders look good, but also probably didn’t change very many votes.

From where I sat — and this will surprise exactly no one — I thought Barack Obama came off the best of the three. He seemed gracious in his call to move past last week’s racial firestorm and deflected the — many — attempts by Russert to re-inject race into the debate. He offered the only funny moments of the evening (Brian Williams thinking he was in LA notwithstanding) and seemed convincing and natural. And, perhaps most importantly, he displayed a command of policy specifics and a capacity for nuance, which once again belies the argument that he’s just a oratorical Hope machine. He seemed, in a word, presidential. (Although I do wish, when asked when he’d first decided to run for president, he’d simply said “kindergarten.”)

John Edwards was as good and on-message as always, but it didn’t seem like he managed to do anything tonight that would be a game-changer. (Then again, in an atmosphere of such explicit convivality as tonight, Edwards’ central message — I will fight for you! — didn’t have much of a chance to gain traction anyway. That being said, he did manage to trump Clinton’s dubious “35 years of experience” claim by announcing that “for 54 years I’ve been fighting with every fiber of my being.” 54 years of fighting? Hey, let’s not forget those nine months in the womb, there.) Edwards also brought up one of the first campaign finance questions we’ve heard in awhile — one in which Obama announced he’d ultimately be for public financing, which made me happy — but due to the moderators not seeming to understand their own rules, it never got around to Senator Clinton, where it was likely — and should have been — directed.

Hillary Clinton came across better tonight than she did in New Hampshire, and, to her credit, she also did her part to uphold the truce (at least in public.) But — again, not a shocker here — I still found her dismayingly evasive on several questions: on Robert Johnson (do you believe his ridiculous clarification or do you think his comments were “out of bounds”?), on whether her opponents were qualified (she couldn’t just say yes?), on the bankruptcy bill (you voted for it in 2001 but was glad it didn’t pass?), and of course, on the politics of fear question, to take a few examples. But, as always, she had done her homework, she smartly went after Dubya a few times, and she had the talking points ready to attack on the Yucca Mountain question. (Without meaning to dismiss the important issue at hand, it’s safe to say “Yucca” is apparently Nevadan for “ethanol.”)

So, at any rate, I’d say Obama came off the best tonight, but Edwards and Clinton were both solid as well. (And I would presume supporters of the other two candidates would say the same, with perhaps the names rearranged.) More than anything, tonight was a chance for tempers to cool and for the party to show it was ready — despite the best efforts of Mr. Russert — to discuss matters of substance again. Still, with Nevada this Saturday and South Carolina right around the corner, I wouldn’t expect the next debate to be so congenial.