“‘There can be no conceivable justification for requiring a soldier to surrender all his clothing, remain naked in his cell for seven hours, and then stand at attention the subsequent morning,’ he wrote. ‘This treatment is even more degrading considering that Pfc. Manning is being monitored — both by direct observation and by video — at all times.‘”

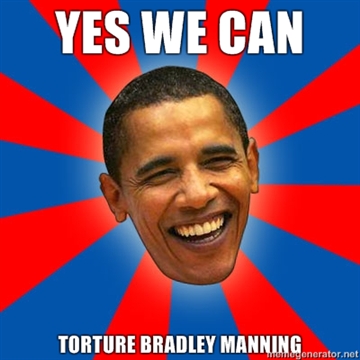

Sometimes I don’t post here because I’m really busy. Sometimes I don’t post here because the news is too damned depressing: The United States takes another big step towards Miniluv by applying Dubya-era torture and intimidation techniques to an American citizen in custody for leaking, Bradley Manning. (Y’see, it’s a four lights = five lights kinda thing. Manning has to break — and then, like Zubadayah and KSM, voice untruths — for there to be any sort of possible criminal conspiracy case against Wikileaks.)

What is there to say, really? State Department spokesman P.J. Crowley already correctly stated that this abusive treatment of Manning was “ridiculous, counterproductive, and stupid,” and, within days, he was fired for stating the obvious.

The president, meanwhile, assures us everything is ok because the Pentagon said so: “I have actually asked the Pentagon whether or not the procedures that have been taken in terms of his confinement are appropriate and are meeting our basic standards. They assure me that they are.” This, as Glenn Greenwald (who’s been on top of this all the way) points out, is exactly the same rationale Dubya used to use: “‘When [Bush] asked ‘the most senior legal officers in the U.S. government’ to review interrogation methods, ‘they assured me they did not constitute torture.’” Well, ok then.

So let’s review. Dubya’s administration constructs an illegal and unconstitutional torture regime — Nobody goes to jail, and nothing changes. (Look forward, not backward!) The Dubya administration lies to the American people in order to prosecute a war of choice in Iraq. Nobody goes to jail, and nothing changes. Through greed and outright fraud, Wall Street traders implode the global economy to the tune of trillions of dollars, and, with the convenient exception of Bernie Madoff, nobody goes to jail, and nothing changes. (Synthetic junk, anyone?) Big banks continue their crime spree by engaging in a massive epidemic of foreclosure fraud, and nobody goes to jail (but we’ll make them promise not to do it again!)

Oh, and an Army private leaks “secret” documents (so secret they were available to millions of people) because “[h]e wanted people held accountable and wanted to see this didn’t happen again” — the very definition of whistleblowing — and now we’re treating him like Winston Smith. (Then again, our president does despise whistleblowers.)

Should Manning be in U.S. custody right now? Yes. He took an oath to the United States military and, knowing full well the consequences, broke it in an act of civil disobedience. If you can’t do the time, don’t do the crime — I get that. But should Manning be abused and tortured in U.S. custody? Of course not — Nobody should be. In fact, I thought we elected Barack Obama as president to make sure this never happened again.

Nope, sorry. Instead, President Obama fired Crowley and is owning what’s happening to Manning right now. He also just reinstated and normalized indefinite detentions at Gitmo. (Obama the constitutional scholar? Meet the Fifth and Sixth Amendments.) And when not perpetuating Dubya-era illegalities, he (and new lefty-bashing chief of staff) spend their days talking up the deficit, talking down regulation, and hoping the Chamber and the NRA take their meetings. Feel those winds of change, y’all. (Obama meme pic above via here.)

Update: “Based on 30 years of government experience, if you have to explain why a guy is standing naked in the middle of a jail cell, you have a policy in need of urgent review.” P.J. Crowley reflects on his recent firing. “I stand by what I said. The United States should set the global standard for treatment of its citizens – and then exceed it. It is what the world expects of us. It is what we should expect of ourselves.“