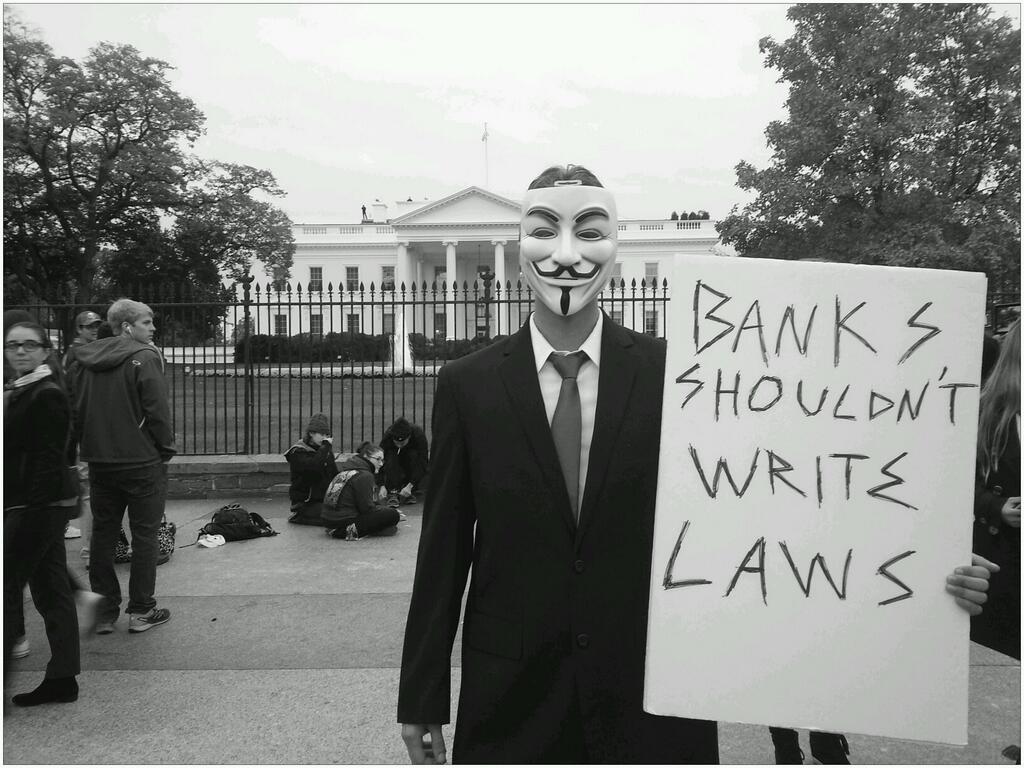

Ever feel like maybe part of the problem with both our Party and our politics is that they tend to reward amoral, money- and power-driven, self-aggrandizing douchebags? Hey, you’re right! Exhibit A: Chris Lehane, previously Al Gore’s flak in 2000 (he also had a small part to play in Dean’s demise in 2004), who’s given the soft-focus treatment in this week’s New York Magazine. “‘You are only seeing 10 percent of what I do,’ Lehane said. The private clients have included Goldman Sachs, Michael Moore, the Weinstein Company and Boeing.”

And here’s Exhibit B: Peter Orszag, who’s currently trying to shield his big Citibank payday from public scrutiny. “Typically, documents in a civil-court proceeding are accessible to the public, but Orszag succeeded last year in quietly convincing a judge to seal financial records submitted in the case, including the salary he makes as a Citigroup vice president, from public view. In that request, Orszag worried that disclosure of his income might harm his career and ‘damage any eventual return to Federal Government service or other public office.'”

Yeah, because everybody’s clamoring for that. Sigh, This Town. Lehane’s right about one thing, tho’. Everywhere you look in DC, there are people who don’t know anything about anything strenuously clambering up the ranks, their only two skills of note shameless self-promotion and a brazen flexibility with regard to what should be basic Democratic principles. Or, as I put it more charitably a few years ago:

“That’s my rub too, and it dovetails with larger problems I have with DC political culture. More often than not, the people who tend to succeed here are the ones who keep their head down, play the DC game, stay resolutely non-ideological and unobtrusive in their opinions. never go out on a limb, never say or do anything that could hurt their bid to be a Big (or Bigger) Shot down the road. (Hence, the whole phenomenon of The Village.)The problem is, these plodding, risk-averse careerist types are exactly the type of people you don’t want making decisions in the end, because they will invariably lead to the plodding, risk-averse and too-often rudderless politics of the lowest common denominator.”

But I guess, as the The Wire made clear years ago, that’s pretty much the rule in any institution or industry, so there’s not much use in complaining about the way things are and have always been. Game’s the same, just got more fierce.