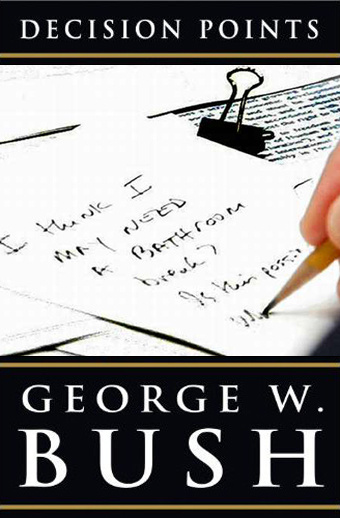

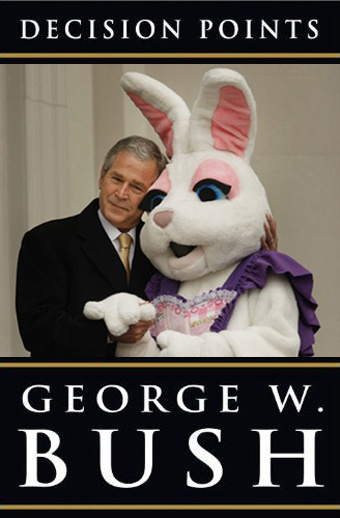

“Decision Point: Is it a good idea for me to land on an aircraft carrier in a flight suit with a sign that says ‘Mission Accomplished‘? Key Decision: How is it not a good idea?” On the announcement that former President Bush’s forthcoming memoirs will be called, um, Decision Points, the wags at the Gawker crime lab have some fun with Photoshop. (Speaking of decision points, I will concede that it’s very smart of the GOP powers-that-be to wait until the week after Election Day to remind America of the Dubya years.)

Don’t let the door hit you on the way out…

After eight long years, the end is in sight, and the Idiot Wind is at long last subsiding. For the 43rd president of these United States, George Dubya Bush, gave his final press conference today, during which he finally conceded that “there have been disappointments.” Why, yes, yes, there have. “Abu Ghraib obviously was a huge disappointment during the presidency. Not having weapons of mass destruction was a significant disappointment. I don’t know if you want to call those mistakes or not, but they were — things didn’t go according to plan, let’s put it that way.” Um, yeah.

At any rate, don’t worry: I’m sure we’ll be getting one last round of 9/11, 9/11, 9/11 before closing time, when Dubya delivers his “farewell address” on Thursday. One can only hope that it turns out to be Eisenhoweresque, and not one more final, futile attempt to rewrite the history books. But I’m not keeping my fingers crossed.

Risky Business.

“What’s interesting about the Madoff scandal, in retrospect, is how little interest anyone inside the financial system had in exposing it…OUR financial catastrophe, like Bernard Madoff’s pyramid scheme, required all sorts of important, plugged-in people to sacrifice our collective long-term interests for short-term gain. The pressure to do this in today’s financial markets is immense. Obviously the greater the market pressure to excel in the short term, the greater the need for pressure from outside the market to consider the longer term. But that’s the problem: there is no longer any serious pressure from outside the market.“

In an extended NYT editorial, authors Michael Lewis and David Einhorn survey recent economic developments with an eye to the broader problem: a financial institutional culture that fosters and legitimates idiotic amounts of risk. “The fixable problem isn’t the greed of the few but the misaligned interests of the many…The tyranny of the short term has extended itself with frightening ease into the entities that were meant to, one way or another, discipline Wall Street, and force it to consider its enlightened self-interest.“

Among the culprits in Lewis and Einhorn’s worthwhile dissection: the credit rating agencies. “In pursuit of their own short-term earnings, they did exactly the opposite of what they were meant to do: rather than expose financial risk they systematically disguised it. ” See also: the S.E.C. “Created to protect investors from financial predators, the commission has somehow evolved into a mechanism for protecting financial predators with political clout from investors…And here’s the most incredible thing of all: 18 months into the most spectacular man-made financial calamity in modern experience, nothing has been done to change that, or any of the other bad incentives that led us here in the first place.“

It’s not all doom, gloom, and (highly justified) finger-pointing. In part two of the editorial, Lewis and Einhorn offer some quick fixes to our current institutional myopia that should be relatively simple to put through…in a perfect world. “The funny thing is, there’s nothing all that radical about most of these changes. A disinterested person would probably wonder why many of them had not been made long ago. A committee of people whose financial interests are somehow bound up with Wall Street is a different matter.“

Barack Obama for President.

So, here we are at last. After the interminable Democratic primary, the mile-high heights of Denver, the RNC’s sputtering lows, all the ignominious Palin follies, and the ugly throes of conservative crack-up we’ve witnessed over the past month or so, it’s at long last decision time.

Not that it’s going to be any big surprise to you, but I myself will be voting for Senator Barack Obama of Illinois, for the reasons I listed back in January and for many others, and I strongly encourage you to do the same.

Of course, voting for Obama tomorrow is a much easier call than choosing among the Democratic field a year ago. If any undecided voters actually swing by GitM (a proposition I highly doubt), well, all you really need to know right now is this:

|

|

That’s it. End of story. If you think Dubya was right 90% of the time, that everything from the wars in Iraq and Afghanistan to the tragedy of Hurricane Katrina to the sub-prime mortgage meltdown to national embarrassments such as Gitmo and Abu Ghraib were handled smoothly — heck, even competently — by this administration, then John McCain is your man. If you don’t, then you should vote Obama.

Similarly, if you think Congress should spend more time pursuing the interests of immensely wealthy corporations and K-street lobbyists rather than representing the American people, that criminals like Duke Cunningham, Boss DeLay, and “Casino Jack” Abramoff should be allowed to plunder the nation’s coffers for personal gain, and that the House and Senate should really be devoting their time to such all-consuming issues as flag burning and the fate of poor Terri Schiavo, then you should vote Republican. If, on the other hand, you want to finally move past all that, and help see real change enacted in this country under a President Obama, then you should vote for your Democratic House and Senate candidates, as I plan to.

Now, of course, I myself would take it farther than that. Y’see, I personally don’t believe that conservatism works as a governing philosophy — it never has, and it never will. You wouldn’t ask a vegetarian to prepare you a steak, and you don’t hire someone who despises government and/or sees it only as his personal bankroll to run a country for you. Unlike the faith-based arguments of all too many Republicans out there, I’d submit that we’ve got almost two decades of data now to back this assertion up. But, you don’t have to take it that far, if you don’t want to — Just look at the record of the last eight years, and that should help clarify who to vote for tomorrow.

As for McCain himself, well, I confess, I’m disappointed in the man. If we’d seen the candidate who ran in 2000, the one who deplored all the right-wing pettiness, racism, and wingnuttery he’s now wallowing in, we might’ve had the first win-win choice for president since…I dunno, Woodrow Wilson and Charles Evans Hughes in 1916? (Update: Upon more reflection, I’ll say since Ike and Adlai in ’56.) But, the Saruman analogy holds here too. In pursuit of power, McCain turned from that path a long time ago — he enabled the Dubya administration in its idiocies, he began to coddle the hardcore right-wing fundies rather than stand up to them, he sold out his own campaign finance reform stance, and he even started to traffick in the same lowest-common-denominator, Rovian filth that was used to bring him low in South Carolina eight years ago. His choice of Sarah Palin for veep, so pathetically craven in its attempt to appease the stark raving fundies and grab disgruntled Clinton voters, was merely the cherry on top.

In short, when the worst impulses of right-wing gutter politics came a-knockin’ at his door, John McCain — for whatever reason — blinked, and completely caved to their onslaught. In this election campaign, he has put His Own Ambition First, and in so doing, he has sold his soul. For the choices he’s made during this election season alone, John McCain has lost any credibility he might’ve had to serve as our nation’s commander-in-chief.

Fortunately, I firmly believe that, after tomorrow, John McCain and the sad, tired remnants of his cause will be old news. We have an exemplary, once-in-a-generation-type candidate in Barack Obama, and I refuse to believe I live in a country that would squander the amazing opportunity before us to elect him our president.

But, you never know… So, yes, the polls look great, but they looked good in 2004 as well (even the exit polls did, in fact), and we all know how that story turned out. So, let’s handle our business tomorrow, get out to vote, and get to work on rebuilding this country. We have so much work to do.

Vote Obama, 2008.

Bailout, or we all sink.

As I said here, I’m not all that happy about the nation having to subsume the risk, and ride to the rescue of, the many banks and Wall Street types that profited massively from these obviously suspect mortgage deals. But, what else is there to do? As with so much else occurring over the past eight years, it befalls us now to clean up the mess left by the free market fundies of late. I just hope we learn something from the economic consequences of this latest binge of free-market fraudulence, before they grow too dire. To wit, whatever the corporate-funded right tells you about self-regulating markets, we need, and will continue to need, real refs on the field.

Update: Uh oh. The bailout compromise dies in the House, prompting the Dow Jones to swiftly tank 700 points. “The measure needs 218 votes for passage. Democrats voted 141 to 94 in favor of the plan, while Republicans voted 65 to 133 against. That left the measure with 206 votes for and 227 against.“

As the TIME article linked above noted before the vote, “the candidate with the most riding on Monday’s vote is McCain, who backed the concerns of conservatives in the House over the initial agreement…[I]f a majority of the House Republicans don’t vote for the measure, McCain could lose political face. ‘If McCain cannot persuade them, it is hard to portray him as a leader,’ said Clyde Wilcox, a political science professor at Georgetown University.” So, that’s the silver lining, I guess. But the bad news now, alas, is considerably worse.

We are all “Socialists” now.

“Let’s be clear about why we’re facing a crisis that could pull down the global financial system. The irresponsibility of individuals who bought houses they couldn’t quite afford pales in comparison with the irresponsibility of the financial wizards who built on those shaky mortgages a towering edifice of irrational faith. Someone in the government should have looked at all those trillions of dollars’ worth of mortgage-backed securities and collateralized debt obligations and credit default swaps and demanded that Wall Street prove that all, or even most, of this purported money was real. But we’re in the eighth year of the Bush administration; adult supervision left the building long ago.” — Eugene Robinson.

Boy, nothing like panic and near-catastrophe in the banking and financial sectors to turn all the stark raving free-market fundies redder than Eugene Debs on May Day, eh? In any event, once again we’re on the verge of learning the hard way that Wall Street does a really lousy job of regulating itself, and that, when push comes to shove, it’s the “don’t-tread-on-me” entrepreneurial capitalists among us who are the first to beg for Big Guvmint to come in and bail them out — at above-market prices. “The only emergency is on Wall Street, and that is entirely of Wall Street’s making. It was the banks that made the loans, the banks that bought the paper, the banks that dumbly believed the models that said that housing prices wouldn’t collapse…How touching to see executives from the likes of Lehman Brothers, not normally an institution associated with widows and orphans, squawk about cutthroat tactics.” And I don’t seem to remember the economic Big Boys, or their mostly-GOP minions in Congress, show such concern about the vagaries of risk when the plight of ordinary folks was being discussed, vis a vis the egregious bankruptcy bill of 2005.

Of course, we can’t just let many of our major financial institutions implode without consequence, and — even though delegating the Dubya administration any more “emergency powers” at this point seems like a colossally bad idea — it seems a given that something will have to be done to sort out all this out, and it will no doubt end up costing taxpayers and aggrieved homeowners a bundle. I just hope, when the dust settles, we remember this time how this all came about, and not just let the idiotic free-market fundies blather on about tax-and-spend liberals killing the entrepreneurial spirit every time some sort of regulatory apparatus is discussed in Washington. We know how that movie ends.

Ok, ok, we need oversight.

“‘Our current regulatory structure was not built to address the modern financial system with its diversity of market participants, innovation, complexity of financial instruments, convergence of financial intermediaries and trading platforms, global integration and interconnectedness among financial institutions, investors and markets,’ Paulson said this morning.” Stick a fork in free market fundamentalism: In light of recent economic events, Dubya Secretary of the Treasury Henry Paulson proposes a massive overhaul of the nation’s regulatory apparatus. The plan, which among other things bolsters the powers of the Fed and phases out the SEC, isn’t getting the most favorable reception from Dems thus far. Said Chris Dodd: “Regrettably, the Administration’s blueprint, while deserving of careful consideration, would do little if anything to alleviate the current crisis — which was brought on by a failure of will.” Still, with even Team Dubya and its allies signing off on the need for it, regulatory reform of Wall Street and financial markets looks to be on the table to stay, one way or another.

The New Deal fights on.

“Despite sustained efforts to tear down the New Deal — from the repeal of the Glass-Steagall Act in 1999 to President George W. Bush’s ill-fated 2005 efforts to dismantle Social Security — the 1930s-vintage infrastructure has proved remarkably durable…Although the Tennessee Valley Authority has yet to pitch in, four 70-year-old agencies are helping to cushion the blow of the housing bust. Let’s count them.” Slate‘s Daniel Gross examines how the New Deal is working to mitigate today’s credit crisis. (He also has a funny line about Sen. Clinton’s bizarre call yesterday to have Greenspan wave a magic wand to fix things: This “is a little like Chicago appointing a cow to a panel on preventing disastrous fires.“)

Red Ink Rising.

“We have no choice but to approve it. If we fail to raise the debt ceiling soon, the U.S. Treasury will default for the first time in its history.” Here we go again: The Senate votes 53-42 to raise America’s debt ceiling by $850 billion “to $9.815 trillion, the fifth increase in the U.S. credit limit since President George W. Bush took office…[This,] the second largest since Bush took office, should be enough to last the government through next year’s congressional and presidential elections. U.S. debt stood at about $5.6 trillion at the start of Bush’s presidency.“

A Taxing Time Ahead.

“‘What strikes me now is the degree to which the fairly fiscally irresponsible policies of the last six years have put Democrats in a box,’ Mr. Greenstein said. ‘They’ve got these large tax cuts in place, they have even larger fiscal problems in the coming decades and they have large unmet needs right now, such as 45 million uninsured people. Addressing all three of those things will be very difficult.’” The NYT discusses briefly how the 2008 Dems are planning to approach Dubya’s tax cuts — As you might expect, everyone agrees that the giveaways to the tiny percentage of wealthiest Americans, those with incomes over $200,000, will have to stop. “‘Yes, we’ll have to raise taxes,’ Mr. Edwards declared in February in one of the first statements by a Democratic candidate on the issue.”