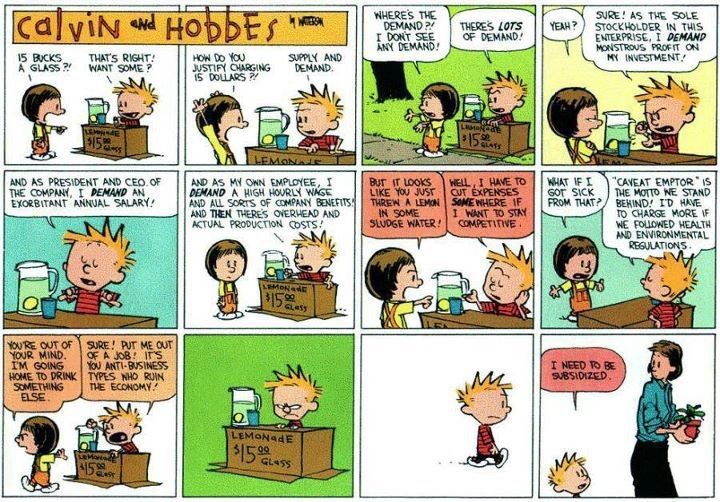

“It sure sounds like a fair place for two hostile opponents to meet. Half the basketball-related income goes to the owners, half the basketball-related income goes to the players and millions of pro basketball fans celebrate their first victory of the season in the form of, you know, a season. But in the end, there’s nothing fair about awarding 50 percent of BRI to the people who amount to 100 percent of the reason there’s any BRI in the first place.“

This, this, a thousand times this. As talks continue and games disappear, Ian O’Connor summarizes the central issue of the NBA lockout: the owners bring no value to the table — they’re basically leeches on the system. “LeBron James, Kobe Bryant, Dirk Nowitzki, Dwyane Wade, Kevin Durant, Derrick Rose — they don’t play in the NBA. They are the NBA. The entire league. The workforce and the product. The owners? They’re just along for the ride.“

Now, the better owners, I think — Mark Cuban, say — understand this. They get that an NBA team is a luxury asset that makes most of its money when it it sold, not as a day-to-day enterprise. And they have a good time playing the owner game and getting to hang around with basketball players.

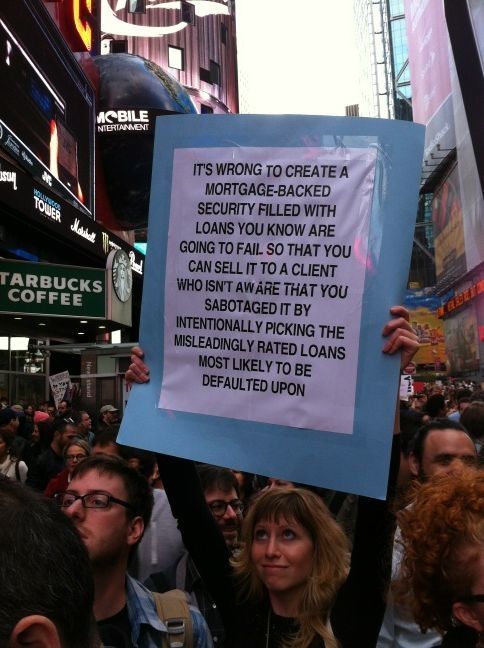

As an aggregate, however, the NBA owners here are the problem. They’ve been lying about their financial straits, and then trying to pin the “downturn” on their employees. Just because the employees are reasonably well-compensated in this instance doesn’t change the fact that this is classic bait-and-switch behavior by management.

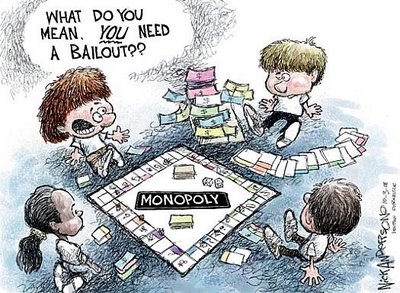

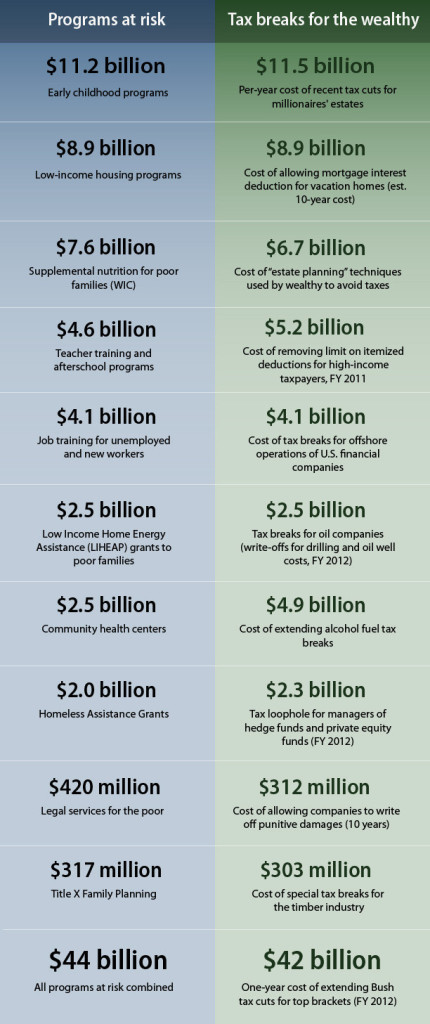

If there’s a reason the NBA is doing poorly at the moment — which, again, is an open question due to all the accounting shenanigans — it’s because unemployment is at 9% and poverty is at 15%. We did not get here because Eddy Curry ate his way to the bottom of a ridiculous contract. Besides, it is not Curry’s fault that somebody wants to pay him $100 million a year for riding the bench anyway. It is the fault of whoever paid him – cough, James Dolan — that exorbitant price. So now, owners want to be bailed out by the powers-that-be for their own terrible business decisions? We’ve seen this movie before. Classic corporate-socialism at work.

I expect the players will probably fold in the end, since, like labor in most situations these days, they don’t have much leverage. But, however it all pans out, let’s remember: The players have the skill set. They create the product. There is no product without the players. In an perect world, the owners should give players a generous share of the revenues (since they’re 100% of the value of the operation), and then be happy they get to own a basketball team. Now, let’s play ball.

Update: “One is, historically, you’ve seen franchises appreciate in value and that appreciation has more than outstripped any cash-flow losses that you’ve had…Secondly, it’s a lot of fun to own an NBA franchise…[B]y and large, NBA franchise ownership has been a good investment. You can’t base long-run projections on how you did in the biggest financial downturn of the last 50 years. On that basis, there are no good investments out there.“

Karl Malone’s gonna play the way Karl Malone can. And Kevin Murphy’s gonna sort out this lockout like Kevin Murphy do.