“I kept dreaming of a world I thought I’d never see. And then, one day, I got in.” The Daft Punk guys release snippets of their upcoming Tron: Legacy score. I have a feeling there’s no way this film can live up to the hype, but these eleven minutes sound pretty darned good.

Month: November 2010

A Life in Development.

Next week, Foreign Policy magazine and its editor-in-chief Susan Glasser will be releasing its 2nd annual roster of the world’s greatest thinkers and doers in foreign policy. I have seen the list — and it’s impressively creative and eclectic. There is one name that is not on the FP100 who should be — and that is Chalmers Johnson, who from my perspective rivals Henry Kissinger as the most significant intellectual force who has shaped and defined the fundamental boundaries and goal posts of US foreign policy in the modern era.“

Next week, Foreign Policy magazine and its editor-in-chief Susan Glasser will be releasing its 2nd annual roster of the world’s greatest thinkers and doers in foreign policy. I have seen the list — and it’s impressively creative and eclectic. There is one name that is not on the FP100 who should be — and that is Chalmers Johnson, who from my perspective rivals Henry Kissinger as the most significant intellectual force who has shaped and defined the fundamental boundaries and goal posts of US foreign policy in the modern era.“

The Washington Note‘s Steve Clemons remembers one of his friends, colleagues, and mentors: Asia scholar, critic of empire, and coiner of the “developmental state,” Chalmers Johnson, 1931-2010. (See also James Fallows’ remembrances on his passing.) Argued Johnson in 2009: “Make no mistake – whether we’re being bled rapidly or slowly, we are bleeding; and hanging onto our military empire will ultimately spell the end of the United States as we know it.”

Portrait of a Mash-Up.

Like mash-ups? Like graphs? The new Girl Talk album, All Day, gets broken down into its constituent samples in a very handy visual format. Whatever the intellectual property consequences, this definitely puts me in a mood for DJ Hero 2.

Crime of the Century.

A tale of two financial crimes: After the Savings and Loan Crisis of the late 80’s and early 90’s — a clear consequence of Reagan-era deregulation, by the way — had run its course, 1852 S&L officials were prosecuted, and 1072 of them ended up behind bars, as did over 2500 bankers for S&L-related crimes. But, when a similarly-deregulated Wall Street plunged the US economy into a much steeper recession two decades later…nobody (with the notable exception of Bernie Madoff) went to jail — In fact, it was barely even admitted by the powers-that-be that serious crimes had even occurred at all. So what happened?

That is the stark question driving Charles Ferguson’s well-laid-out prosecutorial brief Inside Job, which works to explain exactly how we ended up in the most calamitous economic straits since the 1930s. If you’ve been keeping up on current events at all, even if by comic books, stick figures, or Oliver Stone flicks, then you won’t be surprised by the frustrating tale Inside Job has to tell. But unlke the more inchoate and disorganized Casino Jack and the United States of Money earlier this year, which ultimately let its subject wriggle off the hook, Inside Job tells its sad, sordid story clearly, concisely, and well.

The central through-line of the financial crisis by now is well-known. Basically, Wall Steet banksters — relying heavily on “market innovations” (i.e. unregulated toys) like securitization, collaterized debt obligations (CDOs) and credit default swaps — spent the first decade of the 21st century engaged in a trillion-dollar orgy of avarice, criminality, and fraud. And, a few prominent casualties like Lehman Brothers and Bear Stearns aside, the perpetrators of these financial misdeeds mostly walked away unscathed from the economic devastation they wrought. In fact, they’re doing better than ever.

Said banksters got away with this from start to finish mainly becauset they could, thanks to thirty years of deregulation and an absolute bipartisan chokehold on the political process. So, when the bill came due in 2008, these masters of the free market just got the Fed to socialize their losses, thus handing the damage over to the American taxpayer by way of Secretary of the Treasury Hank Paulson (former Chairman and CEO of Goldman Sachs) and his successor, Tim Geithner (no stranger to Wall Street himself.)

As I said recently, my thoughts on the relative necessity of TARP have shifted a good deal since 2008, but, surprisingly, Ferguson doesn’t really get into that debate here. Inside Job is more broad in its focus: It aims instead to show how Wall Street has systematically corrupted both our political process and our economics departments over the course of decades, and nobody is safe from its wrath. Sure, it was probably a tremendously bad idea to let an Ayn Rand acolyte like Alan Greenspan call the shots for the American economy for so long, but he’s just the tip of the iceberg. There are other fish to fry.

After all, it is President Clinton and his financial lieutenants, Robert Rubin and Larry Summers, who preside over the death of Glass-Steagall, the original sin that precipitates all the later shenanigans. It is also they who work to keep prescient regulators like Brooksley Born from sounding the alarm. And, after the house of cards has collapsed in 2008, and President Obama steps up to the plate promising “change we can believe in,” who does he pull out of the bullpen to lead us but…the irrepressibly porcine Larry Summers and Tim Geithner, the Chair of the New York Fed? Meet the new boss, same as the old boss. (But remember, folks, Obama is really an anti-business socialist.)

What goes for the US government goes for the academy as well. As Ferguson shows, Milton Friedman aficionadoes and Reagan/Bush policy guys like Marty Feldstein of Harvard and Glenn Hubbard of Columbia, who now find themselves atop prestigious Ivy League economics departments, are all too happy to give an academic imprimatur to bad bankster behavior, as long as they see a piece of the cut. (Nobody gets it worse than Columbia prof and former Fed governor Frederic Mishkin, who appears here to have walked into a battle of wits completely unarmed.)

In the meantime, Ferguson fleshes out the documentary with related vignettes on the financial crisis and those who brought us low — some work, some don’t. The movie begins with the cautionary tale of Iceland, about as pure a real-time case study into the abysmal failures of deregulation as you can ask for. (If that doesn’t do ya, try Ireland.) But the film ends as badly as it starts well, with an overheated monologue about the way forward, cut to swelling music and images of the Statue of Liberty — a cliche that serves to dissipate much of the pent-up anger of the last 90 minutes. (Perhaps Inside Job should’ve used the lightning strike.)

What’s more, at times Ferguson seems to try too hard to frame guilty men, and never more so than when he has a former psychiatrist-to-the-bankster-stars opine about cocaine abuse and prostitution all over the Street. Sure, it’s unsavory, and I see the ultimate point here — that these petty crimes could’ve been used to flip the lower-level traders if anyone had had tried to bring a RICO case against these jokers. But this sort of bad behavior, however frat-tastically douchey, is extraneous to the real crime at hand, and it seems really out of place when you’re using fallen crusader Elliot Spitzer as a witness for the prosecution.)

Still, overall, Inside Job is a very solid documentary that manages to capture its elusive quarry, and in a better world it would result in more serious consequences for the banksters who put us in this mess. Make no mistake — this is a crime story. As Massachusetts rep Michael Capuano observes in the trailer, and as Woody Guthrie put it many moons ago, “some rob you with a six-gun, and some with a fountain pen.” Thing is, when Pretty Boy Floyd or John Dillinger robbed banks back in the day, they got shot. When the banks rob you…well, that’s apparently another thing entirely.

Lightning Crashes.

Via Boston.com’s indispensable Big Picture, the winners of National Geographic’s 2010 Photography Contest, including this remarkable divine commentary captured by Jay Fine. Definitely worth perusing. (NatGeo is taking submissions through November 30th.)

This used to be my Playground.

That’s great, it starts with an earthquake…On its 6th anniversary, and a little over two years after Wrath of the Lich King, the World of Warcraft is shattering into pieces this morning to make way for Cataclysm on December 7th. [Cinematic.] In other words, the original 2004 release is being completely revamped and updated, and the Old World that I and 12 million other people have been traipsing about in for the past several years is disappearing forever.

(This posed a poignant question for long-time players last night — Where do you go when the world ends? I myself parked my undead rogue on the grave where he was “born” four years ago, atop a hill in Tirisfal Glades, so he could watch the decline from a hazy distance.)

As usual, I’ve got a lot of games on my plate at the moment — CoD: Black Ops, Fallout: New Vegas, Civ 5, Starcraft 2, and DJ Hero 2. I’m still only halfway through Red Dead Redemption, and everything I’ve seen from the Kinect (and particularly Dance Central) suggests it’s a game-changing device in its own right. Still, for what hours I consign to gaming, I usually just keep coming back to WoW. It’s a quality production, through and through.

Groundhog Train.

In the trailer bin of late, Amtrak rider Jake Gyllenhaal is stuck in a moment he can’t get out of in our first look at Duncan Jones’ Source Code, also with Michelle Monaghan, Vera Farmiga, and Jeffrey Wright. Looks a bit too much like Tony Scott’s Deja Vu for my taste, but Jones has already earned the price of admission for this one with Moon.

Abe Drinks Your Milkshake.

“Daniel Day-Lewis would have always been counted as one of the greatest of actors, were he from the silent era, the golden age of film or even some time in cinema’s distant future. I am grateful and inspired that our paths will finally cross with ‘Lincoln.’“

On the seven score and seventh anniversary of the Gettysburg Address, Steven Spielberg announces he has acquired a new Lincoln in Daniel Day-Lewis, replacing the long-attached Liam Neeson. My, that’s good casting.

Dark Side of the Moon.

“Fate has ordained that the men who went to the moon to explore in peace will stay on the moon to rest in peace.These brave men, Neil Armstrong and Edwin Aldrin, know that there is no hope for their recovery. But they also know that there is hope for mankind in their sacrifice. These two men are laying down their lives in mankind’s most noble goal: the search for truth and understanding.“

In a fascinating remnant of alternate history, Letters of Note unearths Nixon’s Safire-penned speech on the (possible) failure of Apollo 11. “Others will follow, and surely find their way home. Man’s search will not be denied. But these men were the first, and they will remain the foremost in our hearts.”

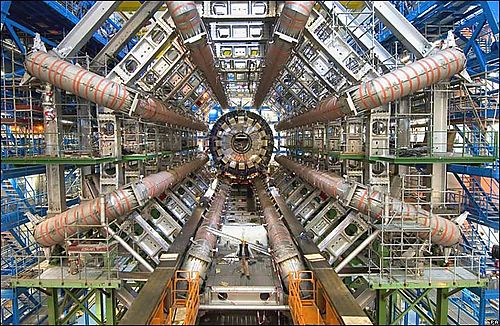

Glimpses of Qward.

“‘What we’d like to do is see if there’s some difference that we don’t understand yet between matter and antimatter,” Professor Hangst said. ‘That difference may be more fundamental; that may have to do with very high-energy things that happened at the beginning of the universe. That’s why holding on to them is so important – we need time to study them.‘”

Scientists at the Large Hadron Collider in Cern have found a way to hold atoms of antimatter for a fraction of a second. “[T]he ability to study such antimatter atoms will allow previously impossible tests of fundamental tenets of physics….'[W]e need a lot more atoms and a lot longer times before it’s really useful – but one has to crawl before you sprint.’”